NHA Slider 1

NHA Slider 2

NHA Slider 3

NHA Slider 5

NHA Slider 4

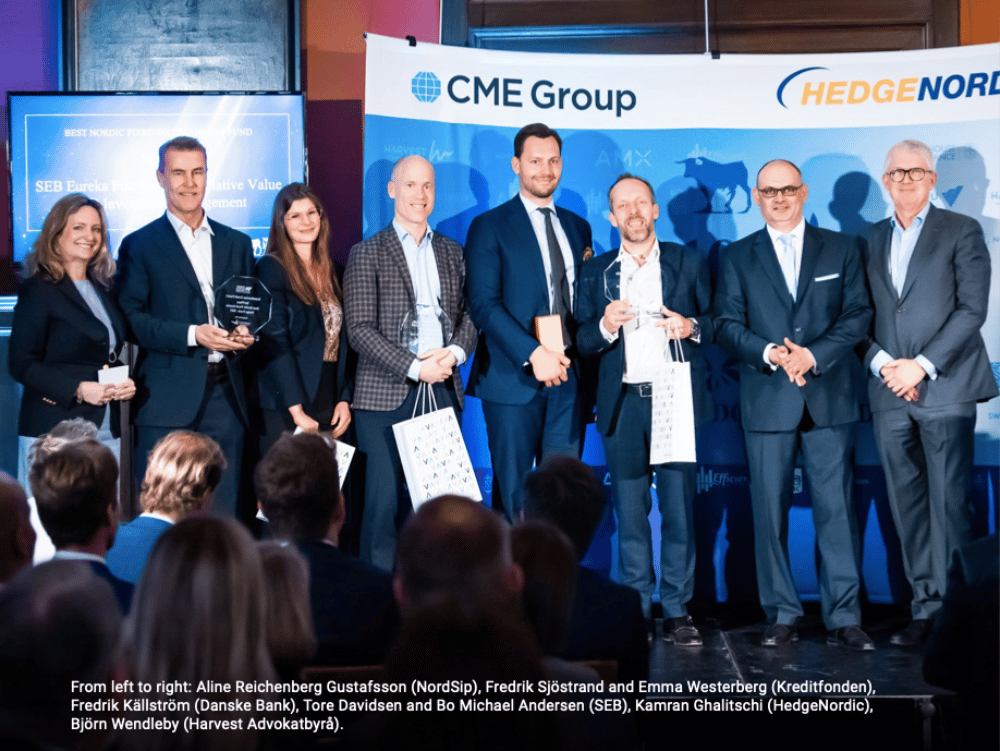

Organized for the first time in April 2013, every year the Nordic Hedge Award distinguishes outstanding hedge fund managers from and active in the Nordic region. All funds listed in the Nordic Hedge Index (NHX) are eligible for participating in the Nordic Hedge Award.